In this blog we will discuss a variety of topics related to valuation including the different methods of valuation, the factors that affect valuation and the latest trends in valuation. We will also provide tips on how to get the most out of your valuation. If you have any questions about valuation, please contact us at [email protected] or (832) 735-7235.

Will Utilities Continue to Outperform? Input Costs and Tariffs

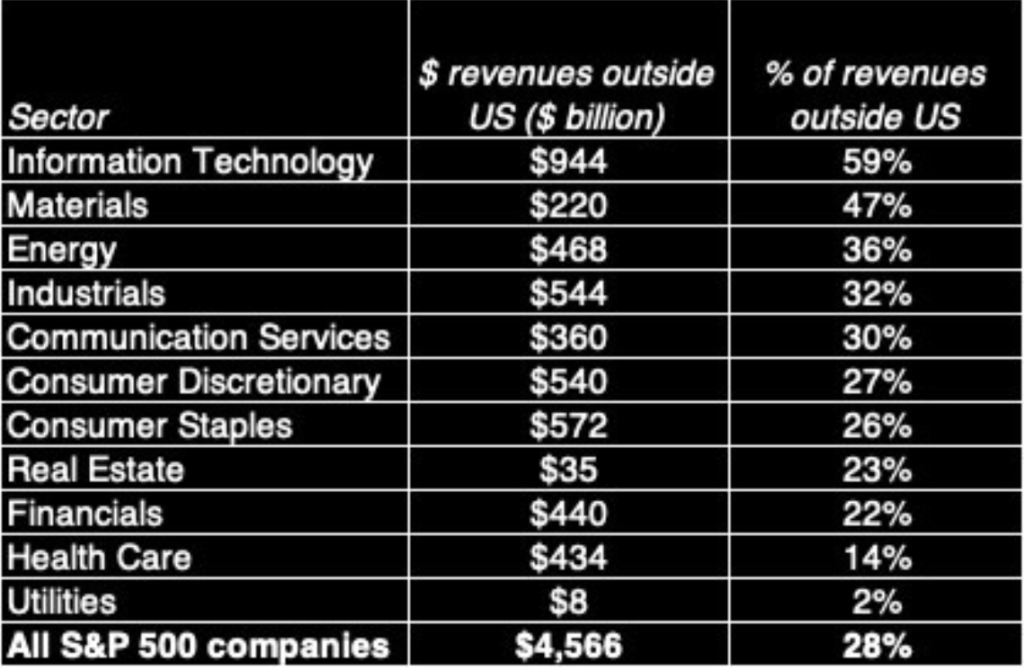

Utilities outperformed in today’s volatile markets, seemingly immune to the broader economic headwinds. The domestic nature of their revenue and the relatively inelastic demand for electricity in the short term appear to be strong tailwinds. But is this outperformance sustainable?

While the immediate picture seems rosy, a critical factor often overlooked is the escalating cost of essential components. Transformers, steel, batteries, solar panels, motors, and copper wires—the lifeblood of the utility sector—are all experiencing significant price hikes. These increases stem from persistent supply chain bottlenecks and, crucially, the ripple effects of rising tariff costs. Some other factors to consider: negative impact of tariffs on investments in AI, electrification of transport and heating, and overall growth rate of electricity? Also, could lower interest rates results in lower allowed returns for regulated utilities? I believe the long-term impact of these tariffs is bad for utilities and renewables, what do you think? Or as famous economist once said, worry about the present and “In the long run, we are all dead”.

Tennis Players sue the Administrators, What Gives?

As both an avid tennis fan and as a valuation professional , I’ve been closely following the concerns voiced by tennis players and fans alike over the years. The recent lawsuit filed by the Professional Tennis Players Association (PTPA) has bubbled these grievances to the front. There are some geniune grievances: a) Tennis players earn less than 20% of the total revenues versus more like 50% for other sports with player representation; b) the ranking system is somewhat opaque and puts pressure on top-ranked players to play 11 months a year while depriving lower ranked players/ venues of resources; and c) The players and the institutions are not doing enough to popularize tennis outside of elite circles in the US and other countries. I shed no tears for Djokovic or any top players because they more than make up for the lost revenues through endorsements and advertising, so its the lower ranked players and venues that are really disadvanted by the current system.

What I would like to see is: a) higher percentage of revenues for lower ranked event venues and players (challengers) to encourage tennis at the grassroots level; b) More transparency in the ranking system with more equal weighting of tournaments. Winning a Grand Slam is an honor in itself, it doesnt need more ranking points and IMO the Davis Cup/ Olympics deserve ranking points; and c) The sport needs to embrace change and experimentation to appeal to a broader audience. Kudos to Team Tennis, Ultimate Tennis Showdown, etc. Please find a more complete analysis compiled with help from Gemini here

Do Government Actions Impact Valuation?

Dr. Aswath Damodaran’s recent article, ‘Investing Politics: Globalization backlash and disruption,’ provides a practical framework for assessing the impact of shifting political landscapes on company valuations. This summary highlights his company-by-company approach, emphasizing the government’s central role and the resulting effects on interest rates, volatility, capital investment, and operating margins. While valuable, the analysis notably omits the backdrop of high valuations and high animal spirits in the US–can interest rates be talked down without triggering a recession?

Insights from the 76th Annual Energy Law Conference

Last week, I had the privilege of attending the 76th Annual Energy Law Conference hosted by the Institute for Energy Law in Houston, Texas. It was an incredible gathering of legal luminaries, energy visionaries, and industry trailblazers!

The conference provided an excellent platform for discussing key topics, hearing from distinguished speakers, and engaging in valuable networking opportunities. Here are some of the compelling topics that were discussed and are right in our wheelhouse:

- Oilfield Services: Contractual disputes, bankruptcy cases, employment-related litigation, and damages calculations.

- Frac Interference: Issues related to fracking in multiple formations, wastewater injection, and processing brine/minerals.

- Environmental, Social, and Governance (ESG) Risks: Transition disputes related to performance shortfalls and equipment failures such as those during winter storm Uri.

- Renewable Assets Performance: Damages related to non-performance or sub-par performance of renewable assets, including benchmarking of performance and costs to wind/solar resources.

- Supply Chain and Infrastructure: Challenges with supply chain, spare parts, stormwater drainage, transformers and supply chain issues for renewable assets.

- Business Model Risks: Exposure to basis risk, hail damage and other related risks.

If you’re interested in learning more about any of these topics, please don’t hesitate to reach out to us!

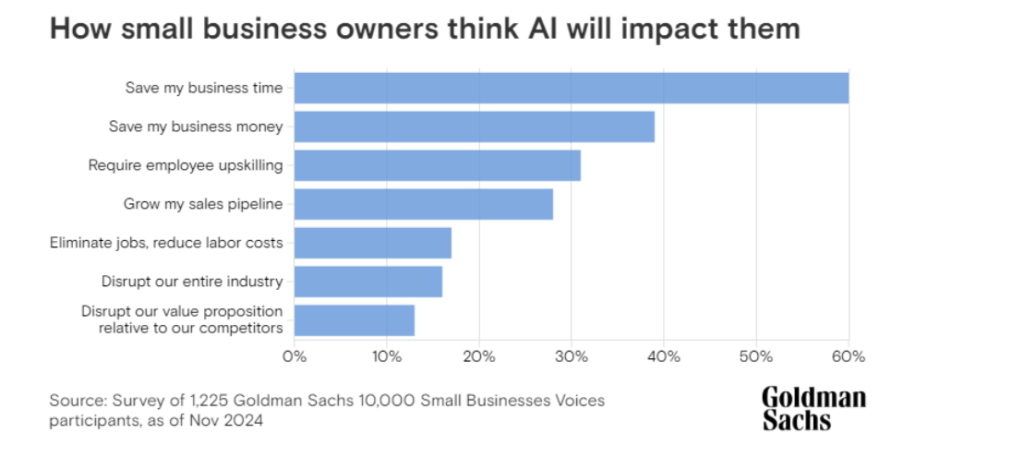

Small Business Owners Bullish about AI: Time, money and sales pipeline

Does America’s Searing Market Rally Bring New Risks or Make the Market More Inclusive?

The Economist raises an intriguing question: Is America’s stock market climbing higher due to its innovative companies or financial innovation? The article highlights the rise of innovative ETFs, such as speculative single-stock leveraged ETFs and the packaging of private market securities, which are now at historically high valuations. It also points out the recent spikes in the volatility index (VIX) and how equity markets are reacting faster to earnings announcements than in the past.

In my opinion, these changes in the stock market can be attributed to the greater participation of retail investors, who tend to follow a momentum-based approach.

Day 1 at Reuters Energy Live 2024: Key Takeaways

Houston, TX – I had the privilege of attending the first day of Reuters Energy Live 2024, a well-attended event that brought together industry leaders and experts to discuss the latest trends and challenges shaping the energy landscape.

Here are some key takeaways from the day’s panels and roundtables:

Favor for Small Independents: The potential return of a Trump administration could significantly benefit small independent oil and gas companies. A less-regulated environment could lower barriers to entry and increase competition, potentially leading to lower oil and gas prices.

Geopolitical Tensions and Detente: Geopolitical factors, including potential detente with Russia and trade tensions with China and Europe, could significantly impact global energy markets.

Renewables and Advanced Geothermal: While the impact of a new administration on renewables remains uncertain, reforms to NEPA could accelerate the development of renewable energy projects, including advanced geothermal. However, increased state control over transmission could hinder necessary investments, potentially boosting the demand for energy storage.

Natural Gas and Hydrogen: A Trump administration is likely to favor natural gas as a transition fuel, which could lead to increased domestic prices due to higher export volumes. Conversely, offshore wind and hydrogen projects may face headwinds.

The AI Factor: A Double-Edged Sword

Many presenters highlighted the potential surge in electricity demand driven by AI data centers and reshoring. While this could provide a significant boost to the energy sector, it’s essential to consider potential mitigating factors, such as the increasing efficiency of AI models and slower-than-expected adoption rates for AI.

The Economist: The Energy Transition will be much cheaper than you think: this article challenges the prevailing gloom surrounding climate change. While the 1.5-degree warming goal remains ambitious, the more realistic 2-degree target offers a longer timeframe to implement cost-effective solutions. Some key points to consider:

Economic Growth and Technology: Current models often overestimate future economic growth rates. But technological advancements, especially in renewable energy and electric vehicles, are often underestimated–most economists assume a fixed percentage decline in costs/ annum but reality could be less linear. The potential for rapid cost reductions in these sectors could significantly impact emissions trajectories.

Global Inequality and Investment: The higher cost of capital in emerging markets can hinder climate investments, in some cases greater than 30% in Africa versus under 8% in developed countries.

However, the global oversupply of manufacturing capacity in solar panels, batteries and EV’s could provide lower prices and easier financing terms for emerging markets.

The Role of Agriculture and Geoengineering: Agricultural innovations, such as advanced crop breeding and lab-grown meat, could transform the sector from a major carbon emitter to a carbon sink.

Geoengineering techniques, while controversial, could lengthen the runway to 1.5 degrees or 2 degrees and decrease overall costs.

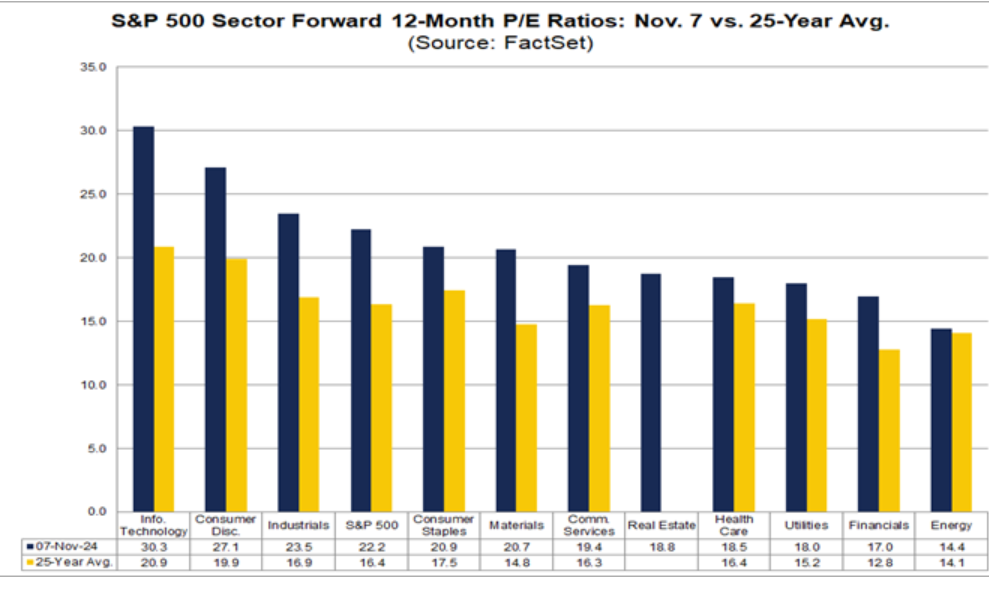

Is this Price to Earnings Ratio for the market justified?

As the graph below shows, market price to earnings ratios are high by historical standards. What is interesting is that price to earnings ratio for all sectors are above historical norms.

Private Equity Courts Retail Investors

Private equity firms are increasingly turning their attention to retail investors, seeking to diversify their funding sources beyond traditional institutional investors. This shift is driven by a combination of factors, including slowing growth in institutional capital allocations and the need for fresh capital to fuel continued expansion.

One prominent example is Blackstone, which is actively expanding its private wealth business into new European markets. By offering retail investors access to alternative investments like private equity and private credit, these firms aim to tap into a vast pool of untapped wealth. However, while the appeal of higher potential returns is undeniable, retail investors may approach private equity with caution. Concerns over liquidity, market volatility, and the illiquid nature of these investments could temper enthusiasm. Please call us if you are interested in evaluating specific private debt and equity investments.

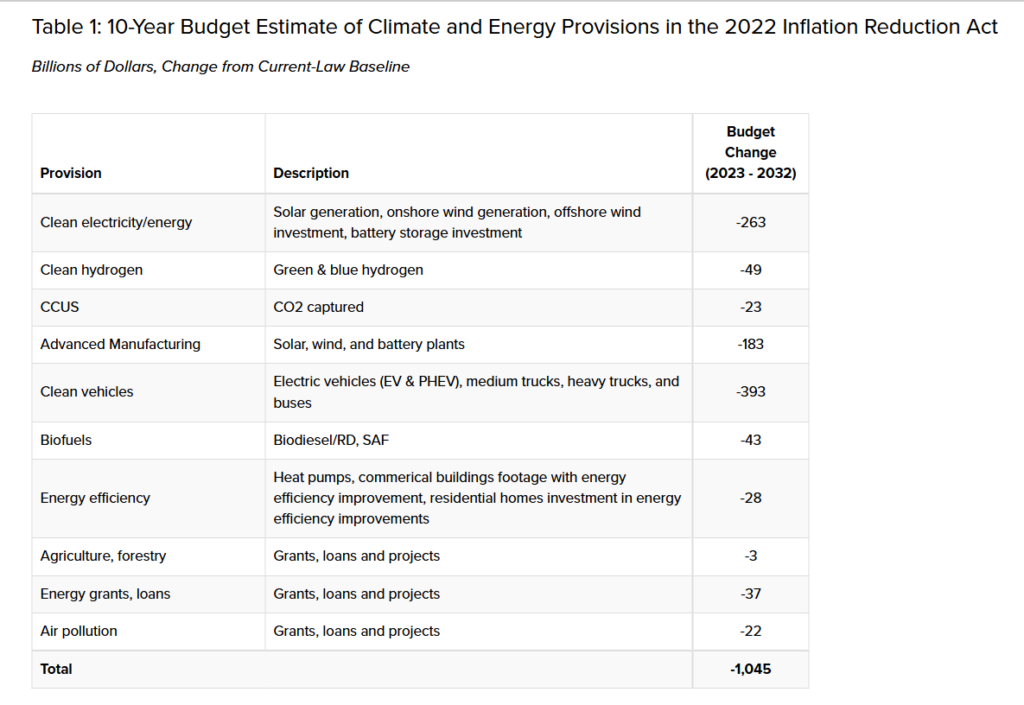

Inflation Reduction Act under Trump (update)

As I wrote one year ago, I believe it is unlikely that the Trump Administration will repeal the Inflation Reduction Act because Red states are the primary beneficiaries of the largess. What is more likely is that it will keep the carrots but remove the sticks: expect roll back of EPA regulations on coal and gas fired power plants; roll back fuel efficiency standards for vehicles and energy-efficiency requirements for appliances; roll back production tax credits for renewable generation which tend to distort market signals and worsen coal and natural gas generation economics. The combined effect of such surgical moves would reduce the cost of the IRA and appease Red states (see cost estimate below). Other losers could include offshore wind and electricity transmission but much of that will be determined at the state level. Moreover, much of the demand for renewable generation is from corporates that want to use clean power for their data center and other needs and its not clear they will change their behaviour.

Does your Small Business have a Super Bowl Moment?

For Calm, the 2020 U.S. Presidential Election was their Super Bowl moment. Amidst the chaos and uncertainty, they capitalized on a unique opportunity to connect with a wide audience by offering a much-needed respite. By strategically placing serene ad breaks and timely social media engagement, Calm emerged as the unexpected brand winner of the night.

Every business, big or small, has the potential for a Super Bowl moment. It’s that specific time or event where your brand can shine, connect with your target audience on a deeper level, and leave a lasting impression. To identify your brand’s Super Bowl moment, consider these questions:

What are the cultural events or trends that align with your brand’s values and mission?

When are your target audience most receptive to your message?

How can you leverage current events to create a unique and relevant campaign?

By understanding your audience and recognizing these peak moments, you can position your brand to capitalize on the opportunity, just as Calm did. Please contact us if you are interested in brainstorming your small business’s superbowl event.

Nuclear Generator stocks still have room to run?

What’s happening: Last Friday, the Federal Energy Regulatory Commission (FERC) rejected a proposal that would have enabled an Amazon data center to share a location with an existing nuclear power plant in Pennsylvania.

The 2-1 decision emerged after a FERC conference with various stakeholders—utilities, consumers, grid operators, and state regulators—focused on improving the process for new grid connections without overburdening the grid. FERC Chairman Willie Phillips, a Democrat who dissented on the order, argued that the commission should be promoting the development of data centers and semiconductor manufacturing as critical national security and economic development priorities.

This announcement lead to speculation that other deals to colocate data centers with nuclear power plants could be adversely impacted–we disagree with this assesment. I believe this case will not impact repowering deals or plants in Ilinois and Texas. In fact, if anything, this ruling makes the case for more bullish returns for all power generators. Please call us for more details!

Goldman Sachs has reduced its equity market returns expectations for the next decade based on market concentration and high current valuations.

As per the GS Equity Strategy team, The most important variable in this forecast is starting valuation. “In theory, a high starting price, all else equal, implies a lower forward return”.

Currently, the 10 largest stocks in the S&P 500 account for more than a third of the total market cap. The current level of market concentration—at a multi-decade high—represents another drag on the analysts’ forecast.

As the chart below suggests, one often overlooked risk is that corporate profits as a percentage of GDP have been rising as a result of lower federal tax rates and lower interest rates. Regardless of the winner of the next election, corporate taxes and interest rates are likely to trend higher over the next decade. Please call us to discuss, especially if you disagree!

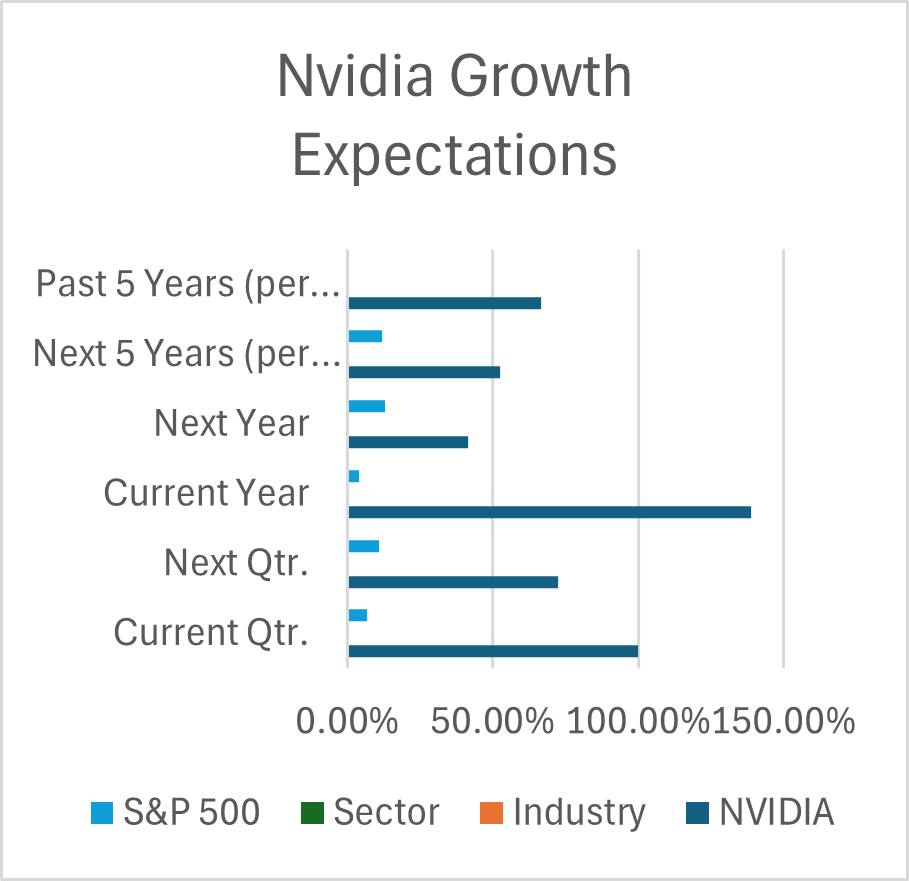

Given the recent warnings from The Economist and renowned valuation expert Aswath Damodaran about Nvidia’s valuation, what are your thoughts about the company’s future prospects?

Specific concerns raised include:

–Intensifying competition: Apple, Google, Amazon, and others developing their own AI chips.

–Emerging technologies: Photonics-based edge computing chips could disrupt the market.

–Evolving AI models: More efficient models may reduce demand for high-powered hardware.

–Supply chain vulnerabilities: Overreliance on TSMC could lead to bottlenecks and concentration risks.

–Balancing act: Nvidia must strike the right balance between profitability and performance to foster AI innovation–tough because it outsources production and needs to pay TSMC to be a priority customer.

–Future competition from Chinese chip manufacturers: Chinese chip manufacturers and AI companies have been sanctioned out of Western technology and there is a risk they could develop a parallel industry and adversely impact prices.

Would you like to delve deeper into any of these concerns or discuss potential counterarguments from Nvidia’s perspective? Ping us!

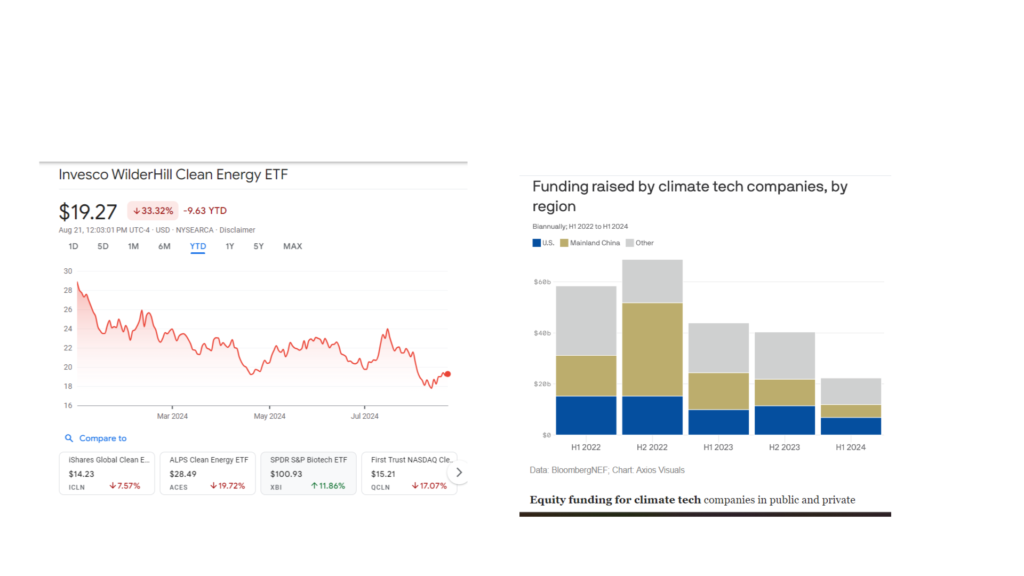

Are your 409A valuations up to date? As the graphs below demonstrate, recent weakness in public comps for Clean Tech companies along with lower funding for the sector could have rendered your firm’s existing valuation out-of-date. An inaccurate 409A can lead to compliance issues, diluted equity, and missed opportunities. We will provide a free audit of your existing valuation and estimate for refreshing the 409A calculation.

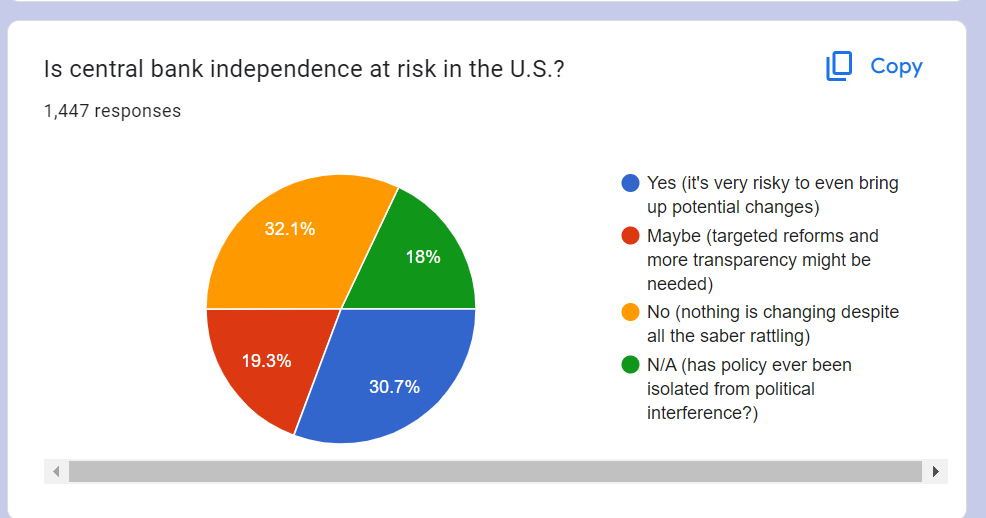

Does the Fed’s Independence matter? Wall Street Breakfast by SeekingAlpha has a survey on the Fed’s independence and the results so far are surprising–only 30% of the survey respondents believe in the sanctity of the Fed’s independence . To participate in the survey or for more details, please go to the SeekingAlpha website. Related question: could the Dollar’s role as the reserve currency of the world be at stake?

Pros and Cons of ending Chevron deference

The Supreme Court’s recent decision in Loper Bright Enterprises v. Raimondo (2024) effectively ended the Chevron Deference. This could have significant implications for the regulatory landscape in the United States, as federal agencies may now have less flexibility in interpreting and enforcing laws.

The Supreme Court’s recent decision means government agencies have less freedom to interpret laws as they see fit. This means they’ll be held more accountable for their decisions, which is a good thing for ensuring careful and consistent lawmaking. It also prevents agencies from overstepping their boundaries and making decisions that should be left to lawmakers.

However, there’s a downside. Agencies often have a lot of expertise in their specific areas, and judges may not be as well-versed in those details. This could lead to less informed interpretations of complex rules. Additionally, more lawsuits are likely to happen as people challenge agency decisions, slowing down the regulatory process and adding to the already heavy workload of the courts.

This change is generally seen as good for businesses, but it could also lead to different rules in different states, making it harder to do business across the country. While federal agencies still have other ways to enforce rules and often have public support, this decision does give some groups a reason to delay things.

Related topics: Most industries regulated at the state level such as utilities and insurance tend to lack competition, and could that be the future of more industries? Also, what can we learn from bankruptcy courts where Judges have to take decisions on complex industry issues? Lastly, does this ruling increase the value of expert witnesses with industry knowledge?

Supreme Court Ruling Sends Shockwaves Through Family Businesses: Estate Taxes to Skyrocket?

The Supreme Court’s recent decision in Connelly v. United States has sent shockwaves through the world of family-owned businesses. The ruling, which mandates that life insurance proceeds be included in the valuation of a company’s shares for estate tax purposes, could lead to a significant increase in estate taxes for many families.

At the heart of the case were two brothers and their closely held corporation, which had a buy-sell agreement in place to repurchase shares upon the death of one brother. The corporation held life insurance policies on both brothers to fund this buyback. In a blow to many family businesses, the Court determined that the life insurance proceeds must be factored into the overall value of the company’s shares, regardless of their intended use. This unexpected decision could leave families facing a much larger tax bill than anticipated, potentially jeopardizing the future of their businesses.

So what can small businesses do? Speak to your estate planning lawyer on how to amend the buy-sell agreement funded by life insurance to avoid the pitfalls of the Connelly decision. Also, please lobby Congress and the Treasury to make this ruling more specific so that it does not apply to all buy-sell agreements funded by life insurance. We will be posting additional analysis and workarounds to this ruling.

Big Tech’s hunger for power could boost natural gas demand in the short-term and lead to more innovations in power generation in the future:

Big tech companies’ growing appetite for computing power to fuel artificial intelligence (AI) is causing a surge in electricity demand. This demand is straining traditional power grids and could lead to a significant increase in natural gas consumption in the short term.

However, big tech is also a major driver of investment in renewable energy sources like solar and wind. They are also exploring alternative energy sources like geothermal and nuclear fusion to meet their power needs in a sustainable way. This investment could lead to significant innovations in clean energy technologies.

Other questions: Why are green generators losing money? What is the role of risk-averse utilities and transmission? What about the oil majors? Is there an investment opportunity in power generators?

https://www.economist.com/business/2024/05/05/big-techs-great-ai-power-grab

https://www.economist.com/business/2023/12/04/the-renewables-business-faces-a-make-or-break-moment

So Many Batteries, So Little Certainty: Volatility in demand for Lithium and Nickel: Recent articles in The Economist and other publications have highlighted the explosion of battery technologies and chemistries under development for electric vehicles (EVs) and stationary storage. This surge, ranging from low-cost sodium batteries to high-performance solid-state NMC batteries, creates a complex landscape for predicting future demand for key battery metals like lithium and nickel.

The sheer variety of technologies in the pipeline makes forecasting extremely challenging. Each chemistry caters to specific use cases and boasts different adoption timelines, further muddying the picture. This uncertainty is reflected in the significant price drops observed in the past year: lithium prices have plummeted by 75%, while nickel prices have fallen by 28%.

This situation presents both opportunities and challenges for the battery industry. While diverse options provide greater flexibility and cater to diverse needs, they also introduce an element of unpredictability for miners and suppliers of raw materials. How does this impact the central planning of supply chains engineered by the second largest economy and how does this impact the localization of supply chains by the OECD? Please call us if you are interested in discussing further.

The Battery Boom and the Venture Capital Conundrum: Will a Multitude of Technologies Dilute Returns? The burgeoning landscape of battery technologies, encompassing both high-end and low-cost options, throws a wrench into the traditional venture capital (VC) return structure. While the plethora of options presents exciting possibilities, it also raises a crucial question: with a multitude of technologies vying for dominance, can we realistically expect every contender to achieve remarkable returns?

Imagine a scenario where five different solid-state battery technologies emerge within the next five years. Will any of them experience 10x returns?

This begs the question: will this dynamic translate into lower overall portfolio returns for VC firms? While the potential for “home runs” exists, the sheer number of technologies vying for attention increases the likelihood of encountering more “singles,” “doubles,” and “strikeouts” compared to a scenario with fewer, more established players.

How does this change in expected returns impact Venture Capital strategy in the clean energy space? Please call us if you are interested in discussing further.

BizBuySell Insights 2023: The BizBuySell Insight Data report for 2023 reveals that despite a robust fourth quarter, small business acquisition numbers remained largely steady compared to 2022. Throughout the year, transactions followed a U-shaped pattern, correlating with the Federal Reserve’s interest rate hikes. Businesses bought in 2023 exhibited stronger financials compared to the previous year, with a notable surge in the fourth quarter. Median sale prices rose, although multiples remained relatively steady. The market saw varying trends across sectors, with manufacturing showing strength, restaurants rebounding steadily post-pandemic, and retail experiencing declines amid inflation and rate hikes. Looking ahead to 2024, cautious optimism prevails, with expectations of a more stable economy and increased activity in the business-for-sale market. Sellers are encouraged to consider financing options, while buyers are advised not to delay their acquisitions. Despite ongoing economic uncertainties, both buyers and sellers are urged to work together to mitigate risks and capitalize on opportunities in the evolving market landscape. Please go to BizBuySell for the original report and do not hesitate to contact us for more takeaways.

Down leg in valuation of tech startups? The cost and availability of capital for venture capital declined in 2023, with reduction estimates ranging from 38% (global) to 75% (US). This also resulted in down rounds for financing based on cues from the public markets. Moreover, as per Cheddar News, roughly 1,200 private companies will exhaust their financial reserves by the end of 2024. Moreover, capital is being sucked into anything with AI and AI-enabled startups, which might cannibalize the business of existing startups.

Please stay tuned for our deep dives into Climate-Tech, Energy-Tech , EV and Infra startups.

COP28: Kudos for including all stakeholders but compromise settlement and some glaring omissions: Overall COP28 brought together different stakeholders including energy producers and representatives from over 200 countries and they agreed on action regarding the transition away from fossil fuels, cutting methane emissions and a loss and damage fund–but it was a compromise agreement and the result was: weak language for the phase out, inadequate funding for the loss and damage fund and lack of concrete timelines and targets.

The deafening silence on reducing subsidies for agriculture and energy consumption is a glaring oversight. These hidden incentives perpetuate unsustainable practices, contributing to both energy and water guzzling. If the energy crisis in Europe has taught us anything, it is that we can cut energy consumption significantly if given the right incentives.

While acknowledging the potential of geo-engineering in adaptation is crucial, it’s imperative to start small-scale experiments now and establish robust policy measures to prevent unintended consequences. This conversation needs to happen, and soon, otherwise this technology could progress in secrecy, and problems will only be discovered when there are major consequences.

With that said, I have a lot of respect for the people that attended the event and I am sure there will be more progress based on the kinship developed during the conference.

Highlights from the subscriber only event by the Economist, “The radical response to big economic shocks”: Keeping with its Libertarian roots, the Economist was critical of the Biden Administration’s ambition to nearshore/ friendshore critical industries such as chips, EV’s, green industries, etc, and in fact, has coined it as “Homeland Economics”.

Key takeaways include:

The Economist believes that industrial policies like the IRA lead to a few national champion winners, but diffuse costs and stagnation, as seen in Japan in the 1970s-80s and China post-2016. Emerging markets could copy this subsidy approach and focus on domestic manufacturing, upending the free trade system that has raised global incomes over the past 30 years. The Economist predicts that this trend will continue for a few years before high debt levels and inflation force a global reckoning.

While the Economist cited some studies to support its claim that subsidies are bad, these studies appeared to be based on black box models. The tone of the call was free market and elitist. A more illuminating discussion would have been about what the government should do instead of doling out subsidies and the structural reasons why subsidies are bad.

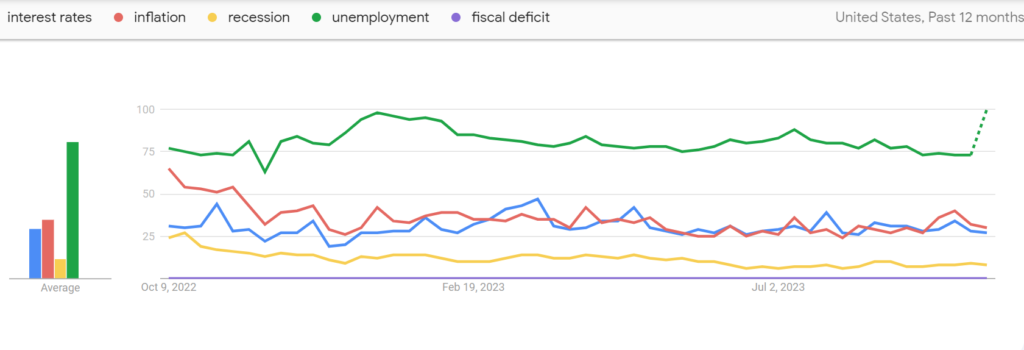

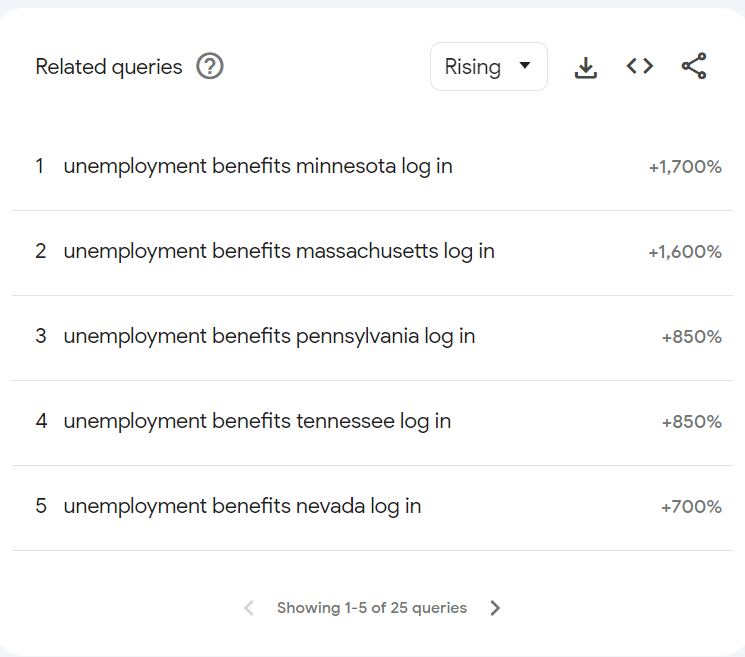

Does the average person care about fiscal deficits?: With so much recent talk about higher interest rates and its negative impact on Corporate and Government balance sheets, I was curious to know if the average person is making the connection between the higher fiscal deficit and higher interest rates; To answer this question, I used Google Trends to determine the relative importance of the following search items: Interest Rates, Inflation, Recession, Unemployment, and Government Spending.

As the graphs below indicate the average person does not connect fiscal deficit with higher interest rates and instead is focused on unemployment. In fact, does the dramatic increase in search for “unemployment benefits login” foreshadow a weaker labor market? Please contact us for the entire analysis: https://trends.google.com/trends/explore?geo=US&q=interest%20rates,inflation,recession,unemployment,fiscal%20deficit

Offshore wind projects face headwinds in the US and UK: A UK auction for offshore wind rights on Friday failed to attract any bids, following a similar result for an auction in the Gulf of Mexico. The lack of interest in these auctions is a blow to the goals of both countries to develop significant offshore wind capacity.

In the UK, the government had set a price cap of £44/MWh (~$55) for the electricity generated by the projects. This was below the level that developers were willing to accept, given the rising costs of offshore wind projects.

In the Gulf of Mexico, the lack of bids was likely due to the lower value of the wind resource, higher costs due to soft soil, need for larger turbines and the recent cost woes.

Read more about the lower value GOM wind resource here: https://espis.boem.gov/final%20reports/BOEM_2020-018.pdf

High yield default estimates going up: Fitch Ratings has revised its U.S. corporates institutional leveraged loan (LL) and high yield (HY) bond default forecasts, citing tighter lending conditions and limited capital access due to banking sector stress and inflation uncertainty. The 2023 HY bond default rate forecast has been raised to 4.5%-5.0% from 3.0%-3.5%, while the 2024 forecast now ranges from 3.5%-4.5%, versus 3.25%-4.25% earlier. These estimates compare with 0.5% and 1.3% in 2021 and 2022, respectively.

Below is a table representing the top five sector exposures as a percentage of U.S. Top Market Concern Loans, based on the given data:

Industry %

Healthcare and Pharma 30

Leisure and Entertainment 11

Technology 10

Telecommunications 9

Building Materials 8 Source: Fitch Ratings U.S. Leveraged Loan Default Index

Conditions for small business owners and investors are getting worse but there could be ways to mitigate risk: On April 30, 2023 Axios reported that small business owners are getting squeezed due to concerns about tighter lending standards post SVB, worsening business climate, and higher inflation. Along with higher interest rates, these are significant headwinds for small business owners and investors. We believe small business owners can mitigate some of these risks by considering alternative funding options including peer-to-peer lending platforms, financing options from the seller, venture capital and angel investors. Please contact us for details.

Takeaways from Kroll CAPM webinar: On April 24, 2023 I attended the Kroll webinar on Developing and Selecting CAPM Betas—A New Module in the Cost of Capital Navigator. Some of the most surprising takeaways came in the surveys during the webinar: a) most of the respondents (51%) said they do not make any forward looking adjustments to historical (OLS) Beta; and b) most of the respondents (45%) do not make adjustments to debt for operating leases.